Wikipeda (*ahem* Web2 *ahem* *ahem*) defines digital assets as,

“Anything that exists in a digital format and comes with the right to use. Data that do not possess that right are not considered assets.

Digital assets include but are not exclusive to: digital documents, audible content, motion picture, and other relevant digital data that are currently in circulation or are, or will be stored on digital appliances such as: personal computers, laptops, portable media players, tablets, data storage devices, telecommunication devices, and any and all apparatuses which are, or will be in existence once technology progresses to accommodate for the conception of new modalities which would be able to carry digital assets; notwithstanding the proprietorship of the physical device onto which the digital asset is located.”

https://en.wikipedia.org/wiki/Digital_asset

Thanks Wikipedia. Now let’s look at the modern world around you.

Published earlier this year (2022),

“The term “digital asset” refers to an asset that is issued and transferred using blockchain technology, including, but not limited to, virtual currencies, coins, and tokens.“

The very first thing this article should accomplish is to open up the landscape to understanding the term for “digital asset” must change, even for people uncomfortable with the words “NFT’s,” Crypto,” “Metaverse,” and “Web3”), and the old saying goes, “Show me the money!!”

- NFT’s

There’s billions of dollars pouring into NFT’s. $17B to be almost exact in 2021, so far in 2022 things are only heating up as each month continues to garner more money. Opensea is the largest marketplace (ethereum and polygon NFTs), while others are happening in an actual game, like Axie Infinity. Ethereum is holding onto most popular flavor, however, Solana, Tezos and Dfinity are sure to make an impact on total sales

Landon Howell, caught a16z’s web3 czar’s theory from Chris Dixon and made a real-live webpage about it (like us old folks do), it categorized NFT’s into seven types:

- Art – These can be a collection like CyberPunks, Doodles, or Bored Apes. There is no doubt this is what caught the hype/shill machine to the word “NFT.” For better or worse. This seems to be the entry point into NFT’s for many. It’s either for facilitating an airdrop or receiving one. An airdrop is when a digital asset lands in your wallet.

- Music – Digital assets in the form of professional music has a lot to lose by going to the blockchain. However, you reap what you sow. Ready to capitalize are artists. They are meeting at the pinnacle of NFT’s, web3 and change. Venture capital funds have allowed many glorious projects to be built Royal.io, where artists can co-own their own music with their own fans. Songs themselves can be sold as an NFT on a marketplace.

- Access – Not much more needs to be said. One could argue the NFT mechanism on blockchain is more legitimized than something like a state-issued ID. The ease of use can make this for everyone, or it can serve as a complex KYC device and replace things like voter cards, ID’s, passports, etc.

- Games – Web2 gamers spend $40 billion per year, gamers don’t own the items they are buying. The game publisher still does, technically. Your gaming profile (and god forbid you have to get a new profile), isn’t true ownership. Another popular metaverse is The Sandbox. Last year, The Sandbox set the record for highest metaverse purchase price of $4.3M. Since then we’ve seen small personal injury attorney offices “enter the metaverse” buying a parcel of land, setting up a shop and sending a press release. That strategy has also been used by many other big name companies. Games can be all encompassing, as art, music, redeemable items and identity can actually take place in a metaverse. Keep in mind, these are very powerful as they also have their own undisputed currency. This is why Bob Iger left Disney for a startup that specializes in metaverse characters for celebrities this week.

- Redeemables – Perhaps the easiest to find a real-life use case for, nothing has ever worked better (than perhaps the “Golden Ticket” Willy Wonka concocted), you buy an NFT, you get the prize. We’ve seen many face-to-face Zoom calls as the prize. We’ve seen VIP passes to parties.

- Identity – Interoperability (take your goods across marketplaces, metaverses, real stores, etc.) The sky is the limit. There is no doubt we did it wrong with Web2. Look around you, every tool you use you are lucky if you can “request a download” before deleting your profile. Big tech has their hands exactly where they want them. We the people deserve to own our own identities and NFT’s will most likely play an integral role in this.

- Web 2 Databases – while these are not as sexy as the others listed, taking the majority of legacy databases and parsing important pieces to be “on chain” could have significant importance.

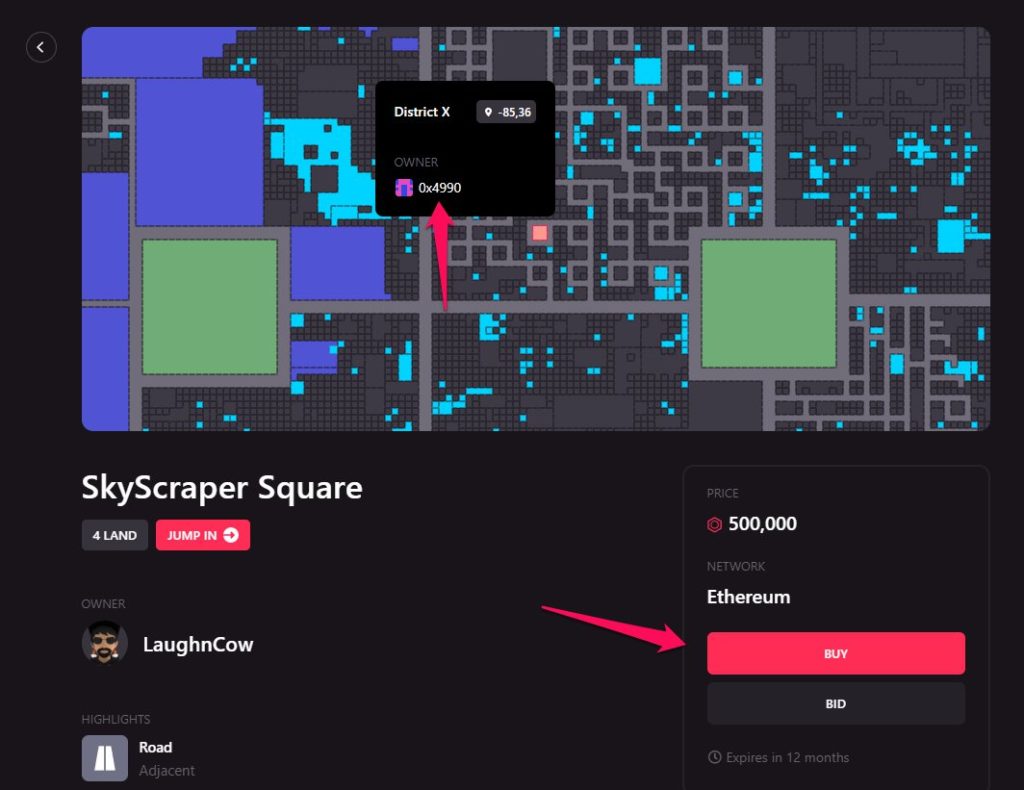

- Metaverse Land

A metaverse is an alternate reality, many crudely simplistic in look, but somehow still able to amass 43 million daily active users. Such popular ones exist as:

The Sandbox – trades as $SAND and has had $340 million dollars of trades in the past 24 hours. Not only that, the most expensive virtual land deal was done in their metaverse.

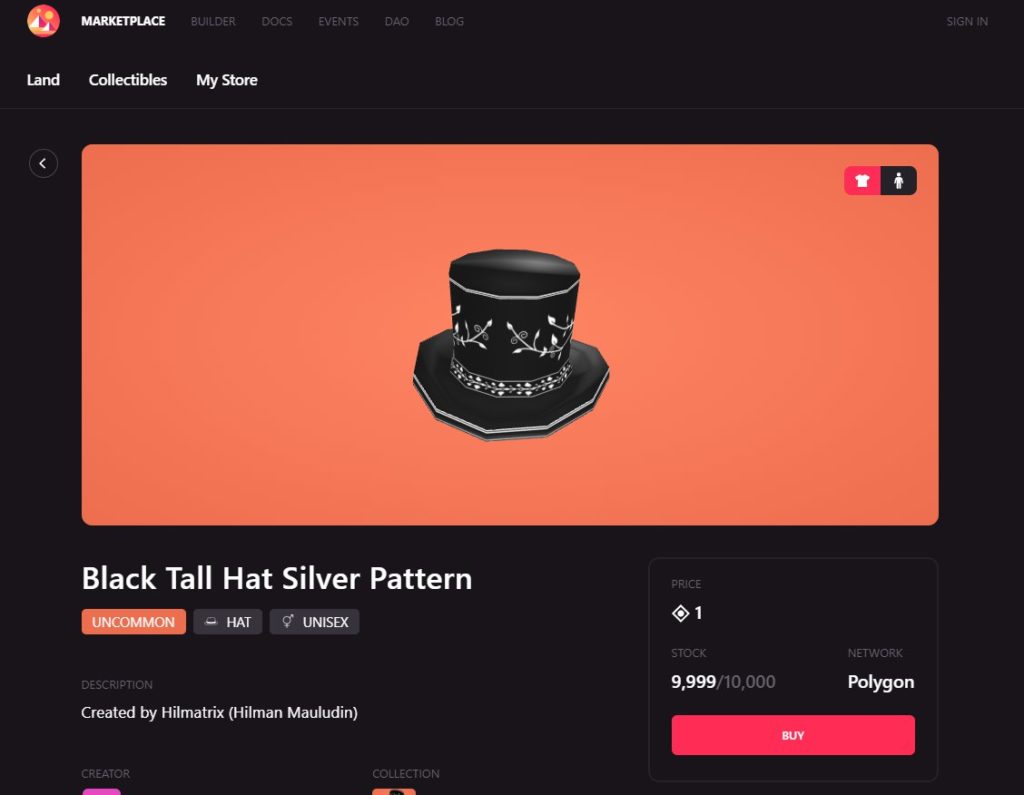

Decentraland – trades as $MANA, sells through it’s own marketplace. Collectibles for your metaverse avatar may include a monocle or this fancy top hat. These “games” not only have their own world. They have their own currency.

However, these collectibles are considered to be digital goods. As they, as well as other assets can retain their value. Land purchases in metaverses have also made a splash.

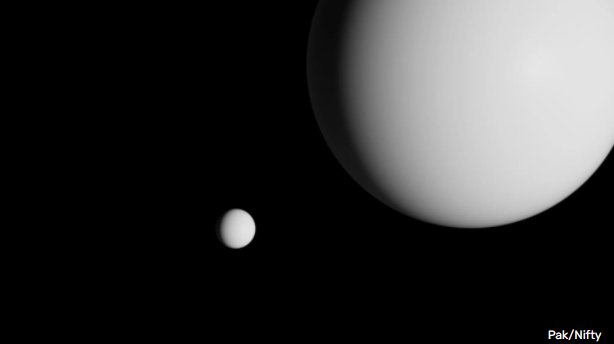

- Most expensive art NFT

This is a beautiful representation of fractionalization of ownership on pretty things outside our means. “The Merge” brought in a whopping $91 million dollars from 29,983 collectors.

The Merge was sold in an open edition (the opposite of limited edition) for just a few days. Buyers could purchase any number of tokens starting with a unit price of US$575, which increased by US$25 every six hours. By the end, the tokens sold for a total of US$91.8 million.

The more mass buyers accumulated, the bigger their mass got.

- Lebron James’ hidden QR code redeemable art

Found at the ten second mark, visible for just a tenth of second!! The company revealed that 5,550 exclusive NFTs had been airdropped to fans through a hidden QR code in the spot.

- How about an NFT that gave you free beers for life?

Denver Beer Co. wanted to know what it was worth. Turns out, at the time, it was worth just about $10,000.

While the categories of NFT’s may expand, as we learn how to better embrace their unique ability to turn complex mechanisms into a shiny object or actual art. The fact is, they can be proven to be owned, taxed and will be only growing more into our every day lives and businesses.